Palau Chamber Of Commerce - Truths

Fascination About Palau Chamber Of Commerce

Table of ContentsThings about Palau Chamber Of CommerceWhat Does Palau Chamber Of Commerce Do?The Ultimate Guide To Palau Chamber Of CommerceThe 8-Minute Rule for Palau Chamber Of CommerceGetting The Palau Chamber Of Commerce To WorkNot known Factual Statements About Palau Chamber Of Commerce Top Guidelines Of Palau Chamber Of CommerceThe 15-Second Trick For Palau Chamber Of Commerce

As a result, nonprofit crowdfunding is ordering the eyeballs these days. It can be made use of for particular programs within the company or a basic donation to the cause.During this step, you may desire to think about landmarks that will indicate a possibility to scale your not-for-profit. As soon as you've run for a bit, it's vital to take some time to assume about concrete development goals.

A Biased View of Palau Chamber Of Commerce

Without them, it will certainly be hard to review as well as track progression in the future as you will certainly have nothing to determine your results versus and also you will not understand what 'successful' is to your nonprofit. Resources on Starting a Nonprofit in various states in the United States: Beginning a Not-for-profit FAQs 1. How a lot does it cost to start a not-for-profit organization? You can begin a not-for-profit organization with a financial investment of $750 at a bare minimum as well as it can go as high as $2000.

All about Palau Chamber Of Commerce

With the 1023-EZ kind, the handling time is generally 2-3 weeks. Can you be an LLC as well as a nonprofit? LLC can exist as a nonprofit limited liability business, nonetheless, it needs to be totally had by a single tax-exempt not-for-profit company.

What is the difference between a structure as well as a nonprofit? Foundations are usually moneyed by a family members or a corporate entity, however nonprofits are moneyed through their revenues and also fundraising. Foundations usually take the cash they started with, invest it, as well as after that disperse the money made from those investments.

Getting The Palau Chamber Of Commerce To Work

Whereas, the extra cash a not-for-profit makes are made use of as running expenses to fund the company's mission. Is it difficult to start a not-for-profit organization?

There are numerous steps to begin a nonprofit, the obstacles to entrance are relatively couple of. Do nonprofits pay tax obligations? If your nonprofit earns any type of income from unassociated tasks, it will certainly owe revenue tax obligations on that quantity.

Palau Chamber Of Commerce Fundamentals Explained

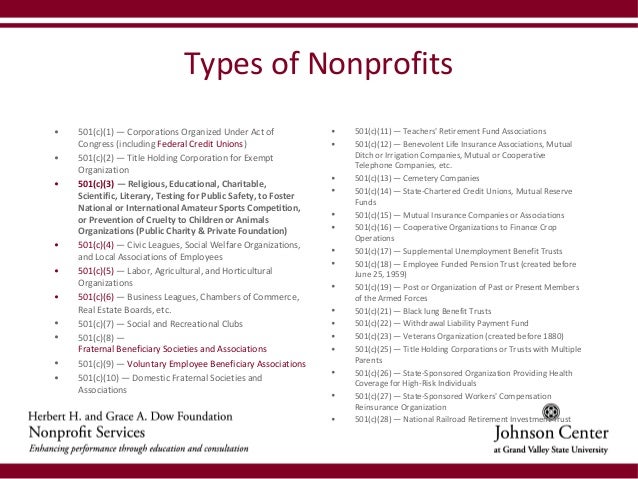

By far the most usual type of nonprofits are Section 501(c)( 3) companies; (Area 501(c)( 3) is the component of the tax code that accredits such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, educational, or scientific.

A Biased View of Palau Chamber Of Commerce

The bottom line is that exclusive foundations obtain much worse tax obligation treatment than public charities. The primary distinction in between personal structures and also public charities is where they obtain their financial backing. An exclusive structure is typically managed by a private, family members, or corporation, as well as obtains many of its revenue from a few benefactors as well as investments-- a fine example is the Expense and also Melinda Gates Structure.

The Buzz on Palau Chamber Of Commerce

This is why the tax legislation is so difficult on them. Most foundations just offer cash to various other nonprofits. Nonetheless, somecalled "operating foundations"run their own programs. As a functional matter, you require at the very least $1 million to start a private structure; otherwise, it's unworthy the difficulty and also expense. It's not surprising, after that, that a personal structure has been referred to as a big body of cash bordered by individuals that desire several of it.

Other nonprofits are not so fortunate. The IRS at first assumes that they are exclusive foundations. Nevertheless, a brand-new 501(c)( 3) company will be categorized as a public charity (not an web exclusive structure) when it uses for tax-exempt condition if it can show that it fairly can be anticipated why not try this out to be publicly supported.

The smart Trick of Palau Chamber Of Commerce That Nobody is Discussing

If the internal revenue service categorizes the nonprofit as a public charity, it maintains this condition for its initial 5 years, despite the public support it really receives throughout this time. Palau Chamber of Commerce. Beginning with the nonprofit's sixth tax obligation year, it should reveal that it fulfills the public assistance test, which is based on the assistance it obtains throughout the current year and also previous 4 years.

If a not-for-profit passes the examination, the internal revenue service will remain to check its public charity status after the first five years by calling for that a finished Schedule A be submitted each year. Palau Chamber of Commerce. Figure out even more concerning your not-for-profit's tax obligation status with Nolo's publication, Every Nonprofit's Tax Guide.